Home > Electronic Contract Solutions for the Financial Industry

Pain Points in the Financial Electronic Contract Industry

High Risk Control Requirements

The financial industry requires strict real-name authentication, and the signing process must comply with legal and regulatory requirements.

Strict Operation Requirements

Numerous financial regulatory rules issued in the past have imposed detailed and strict requirements on contract signing, storage, and management in the internet finance industry.

Long Investment/Lending Cycles

Offline service experience is poor and time-consuming, failing to meet the needs of borrowers in urgent need of funds.

Application Scenarios of Financial Electronic Contracts

Banking

Account opening agreements, loan agreements, etc.

Auto Finance, Consumer Finance

Financial leasing contracts, pledge agreements, installment payment agreements, guarantee agreements, etc.

Microfinance, Insurance

Credit reference authorization, loan contracts, electronic insurance policies, insurance receipts, etc.

Credit Entrustment

Property trust agreements, beneficiary assignment agreements, etc.

Financial Electronic Contract Solutions

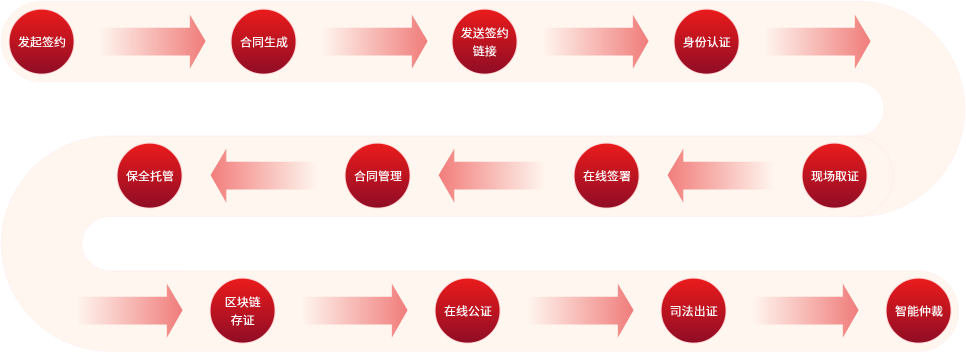

In response to banks' requirements for electronic signing, electronic data storage, and post-loan processing, Junziqian provides banks with electronic data collection starting from signing. It forms a full evidence chain of electronic signing through technical means, followed by mid-term structured and element-based processing of electronic evidence items, intelligent matching of various judicial document templates, and finally realizes one-click litigation and batch submission of judicial cases within the bank's internal network.

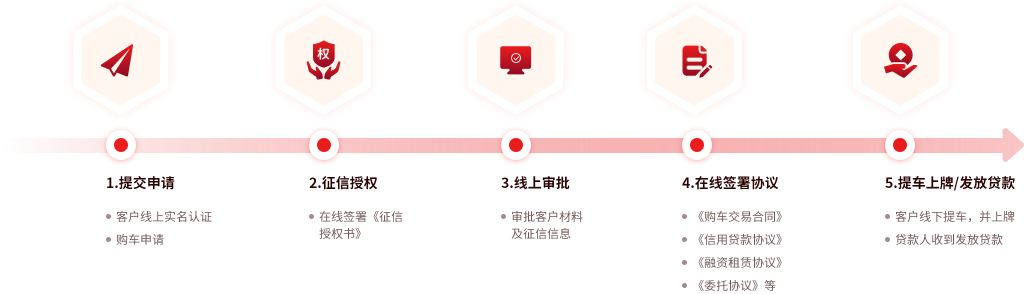

Junziqian provides customers with services such as financial leasing for car purchases, credit loans for car purchases, and vehicle mortgage loans. Its business processes involve document submission, credit reference authorization, and include agreements such as the Financial Leasing Agreement, Installment Car Purchase Agreement, Vehicle Entrusted Purchase Service Agreement, and Pledge Agreement. All types of agreements are signed online; electronic contracts are convenient and efficient, signing data is stored in real time, and willingness authentication ensures the user's true intent.

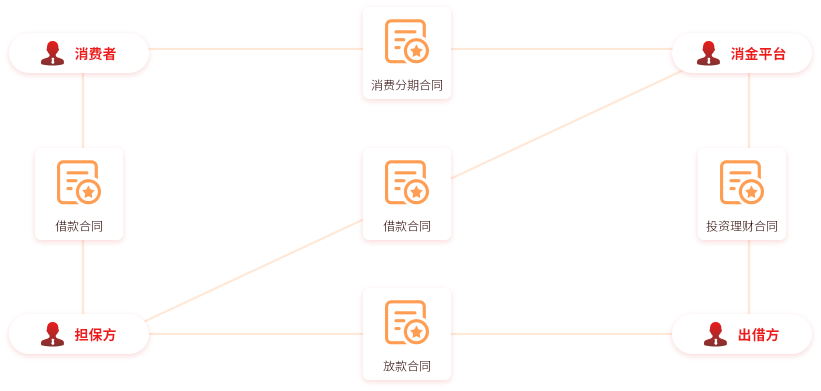

Junziqian provides online signing capabilities for consumer installment platforms, solving problems such as high mailing costs and long signing times for cross-regional contract signing, which is more suitable for the usage characteristics of internet users. Junziqian's electronic signing platform offers multiple willingness verification methods, including SMS verification, 3-4 key elements of bank cards, and liveness face recognition, ensuring that the signer is the actual user of the installment consumption service. Using this method to sign contracts can effectively solve the problem of high breach risk in cross-regional signing.

Junziqian provides a full evidence chain electronic signing solution for microfinance enterprises. It enables borrowers to sign online (electronic data collection), store the signed electronic contracts and evidence of the entire electronic signing process in real time, and synchronize the hash digest of electronic data (original electronic contracts, process logs, face authentication videos, log files, etc.) to the "Preservation Chain". This blockchain is jointly built by Junziqian in collaboration with judicial institutions such as notary offices, judicial authentication centers, arbitration commissions, and internet courts. It solves problems such as electronic data being prone to tampering and loss, realizes the management of the electronic evidence chain throughout the business process, conducts structured and element-based management of electronic evidence, intelligently matches various judicial document templates, and finally achieves post-loan disposal services such as one-click litigation and batch arbitration.

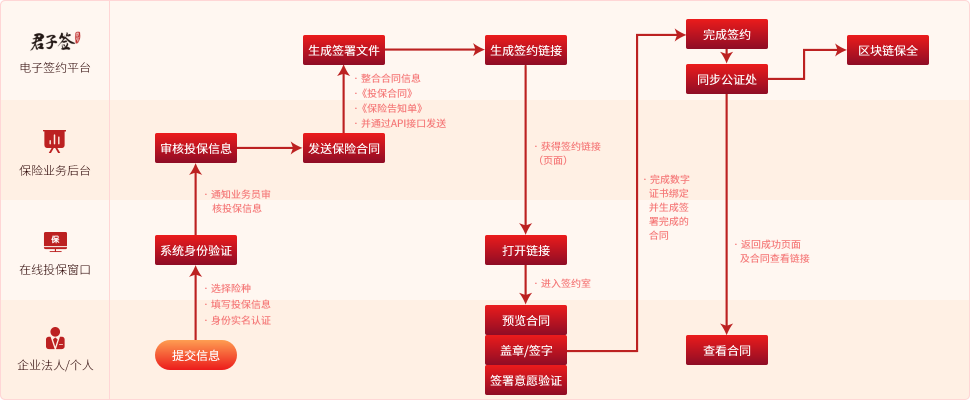

In the insurance business, Junziqian's electronic signing can be accessed via cloud-based API integration or on-premises deployment. Insurance contracts, claim settlement agreements, insurance preservation service agreements, and monthly statements can be signed online within the existing business system. After signing, the electronic contracts will undergo notarization and data preservation, and insurance application information can be promptly informed to and retained for customers via SMS notifications and other methods.

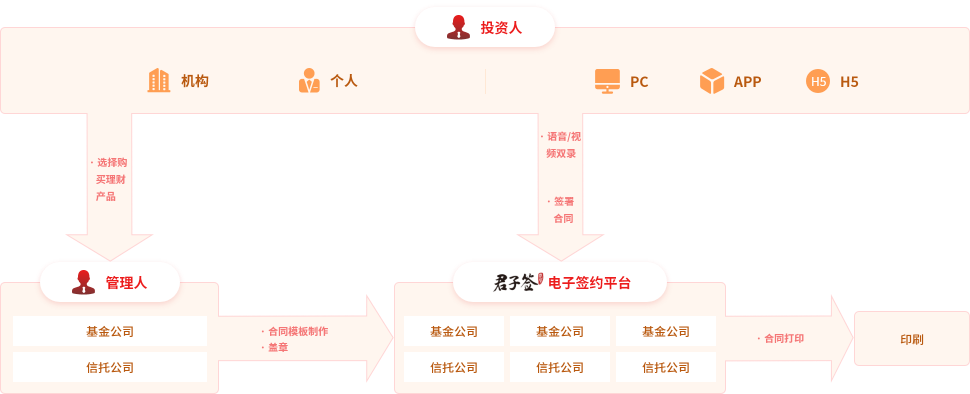

In trust scenarios, fund companies can create electronic contract templates or select existing templates and set official seals through Junziqian's electronic signing platform. After investors select trust products in the system, they conduct identity authentication within the system and complete the electronic contract signing. After signing, both parties can view or download the electronic contracts; meanwhile, the electronic contracts and evidence of the electronic signing process will be uploaded to the blockchain for preservation, ensuring the objective authenticity of the documents and enhancing legal validity.

Advantages of Financial Electronic Contract Solutions

Convenient Contract Management

Online signing eliminates the need for in-person interaction; electronic contracts can be downloaded and viewed online, with electronic archiving. There is no need for dedicated personnel to manage paper contracts, improving efficiency and reducing costs.

Data Storage

CA certificates + blockchain + timestamps provide three-dimensional encryption protection. Data such as electronic contracts and evidence of the electronic signing process are synchronized to arbitration commissions, copyright institutions, notary offices, internet courts, etc.; effectively ensuring data security.

Online Evidence Issuance

Junziqian's electronic signing platform connects to arbitration commissions, copyright institutions, notary offices, internet courts, etc., allowing one-click application for online evidence issuance in the backend.

Financial Electronic Contract Cases

渝公网安备 50019002501878号

渝公网安备 50019002501878号

信查查

信查查